"GOLD and SILVER Are Money, Everything Else Is Credit" - J.P Morgan

Disclosure: This website contains affiliate links.

When you click on these links and make a purchase, I may receive a commission at no additional cost to you.

I only promote companies that I have personally used or researched and believe will add value to our readers.

When you click on these links and make a purchase, I may receive a commission at no additional cost to you.

I only promote companies that I have personally used or researched and believe will add value to our readers.

Disclosure:

The content I provide here isn’t financial advice and cannot be taken as such. Please speak to your financial advisor before making any investment decision.

Also, note that every investment comes with its own risks and drawbacks. Lastly, I would like to remind you that past results cannot guarantee future returns.

The content I provide here isn’t financial advice and cannot be taken as such. Please speak to your financial advisor before making any investment decision.

Also, note that every investment comes with its own risks and drawbacks. Lastly, I would like to remind you that past results cannot guarantee future returns.

Musk: America On The Verge Of Bankruptcy

Billionaire Elon Musk has warned that America could be nearing the verge of bankruptcy.

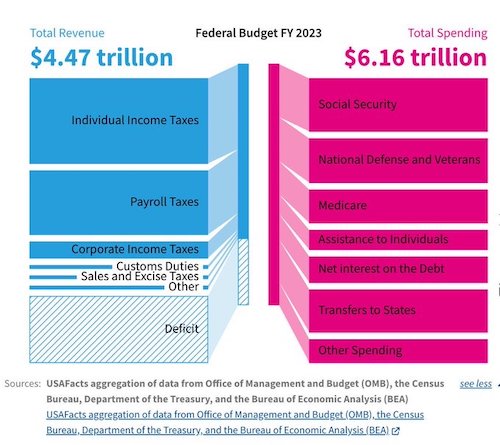

As the chart shows, in 2023 the US Government collected $4.47 trillion, but spent $6.16 trillion, adding $1.69 trillion to the National Debt.

Not only that, he US Debt to GPD is 129%, the HIGHEST IT HAS EVER BEEN.

As Elon Musk has said, "This is not sustainable."

"The US dollar Is in Decline" - Elon Musk

Inflation can cut into a portfolio just as much as any other form of risk. The declining value of the dollar can put pressure on stocks, as well as savings accounts and bond holdings.

But more important for retired Americans, they should be looking for ways to protect their life saving. One way is to diversify and protect their retirement savings against economic and geopolitical uncertainty.

Be it debt ceiling worries, high inflation, high interest rates, high government spending, dollar devaluation, or overall unpredictable markets, retirees are truly in a “pick your poison” situation that our nation has never experienced before.

One defensive investment strategy gaining prominence is the conversion of part of your IRA or 401(k) into physical gold.

Here's why this could be beneficial:

Hedge Against Inflation and Deflation:

Gold has historically been a powerful hedge against both inflation and deflation. Gold has had intrinsic value, and had purchasing powers when paper currencies lost their value.

But more important for retired Americans, they should be looking for ways to protect their life saving. One way is to diversify and protect their retirement savings against economic and geopolitical uncertainty.

Be it debt ceiling worries, high inflation, high interest rates, high government spending, dollar devaluation, or overall unpredictable markets, retirees are truly in a “pick your poison” situation that our nation has never experienced before.

One defensive investment strategy gaining prominence is the conversion of part of your IRA or 401(k) into physical gold.

Here's why this could be beneficial:

Hedge Against Inflation and Deflation:

Gold has historically been a powerful hedge against both inflation and deflation. Gold has had intrinsic value, and had purchasing powers when paper currencies lost their value.

"GOLD is the last safe haven against the US Debt Disaster"

- Bank of America

- Bank of America

Portfolio Diversification Against The Markets:

Adding physical gold to your portfolio can reduce volatility and risk, as gold often moves independently of stocks and bonds.

Tangible, Secure “Hard Asset”:

Physical gold is a real, tangible asset that you can hold, unlike digital or paper assets which can be vulnerable to cybersecurity threats and systemic failures. Also, unlike other fiat currency, gold has no counter-party risk.

Historical Store of Value:

Gold has maintained its value throughout millennia, standing strong through countless economic crises and downturns.

Maintain Purchasing Power:

Unlike many other assets, an ounce of gold has maintained its purchasing power through centuries, and is currently experiencing historic highs.

These reasons are why central banks have been ramping up their gold reserves at a record pace since 2013.

And it’s not just central banks… Institutional and investors have also allocated a portion of their portfolio to gold and silver to preserve their wealth.

Noble Gold Investments, specializes in helping 401k and IRA owners through the process of converting part of their savings to physical gold. As an A+ rated company by the Better Business Bureau, they prioritize transparency, integrity, and your financial security above all else.

Don’t be left behind, request your Free Gold IRA Guide today to learn more about how you too can diversify and protect your portfolio in 2024.

Millionaires Hedging

Their Bets With Gold

Paul Tudor Jones

$7.5B Net Worth

5% gold allocation

$7.5B Net Worth

5% gold allocation

Kevin O'Leary

$400M Net Worth

5% gold allocation

$400M Net Worth

5% gold allocation

Ray Dalio

$19.1B Net Worth

8% gold allocation

$19.1B Net Worth

8% gold allocation

Kyle Bass

$3B Net Worth

10% gold allocation

$3B Net Worth

10% gold allocation

Rick Rule

$133M Net Worth

10% gold allocation

$133M Net Worth

10% gold allocation

Jim Rickards

$19M Net Worth

10% gold allocation

$19M Net Worth

10% gold allocation

Nobel Gold Investments has more than 20 years of dealing with bullion, coins, ingots, and other precious metals

They are sought out and consulted by financial agents, estate planning attorneys, and certified public accountants to advise them on all aspects of precious metals, having secured more than $200 million in precious metal assets.

With Noble Gold Investments you will be treated like an elite investor. Upon enrolling with Noble Gold, you will know who our CEO is and who you will be handing your money too.

Noble Gold sells gold & silver and also provides great service to their customers.

They are sought out and consulted by financial agents, estate planning attorneys, and certified public accountants to advise them on all aspects of precious metals, having secured more than $200 million in precious metal assets.

With Noble Gold Investments you will be treated like an elite investor. Upon enrolling with Noble Gold, you will know who our CEO is and who you will be handing your money too.

Noble Gold sells gold & silver and also provides great service to their customers.